Understanding European Union Value-Added Tax (VAT): Structure, Consequences, and Perspectives

It is considered one of the basic features of the EU tax system and the most important source of income out of all the different taxes imposed by the European Union's member states. The VAT system offers a harmonized approach towards tax in the European Union and thus makes trade easier. The following paper provides a comprehensive overview of the European Union's Value-Added Tax, its structure, implications from both a business and consumer point of view and the issues that surround it.

What is VAT?

The value-added tax is the consumption tax leveled on the value added to commodities and services at some stage of their production and distribution. Unlike sales tax, which is only levied on the ultimate sale of a product to a consumer, VAT is payable at every production stage of a product's supply chain. In this system, businesses have the facility to recover the VAT they have been charged on their inputs; therefore, they shift the burden of the tax to the ultimate consumer in the form that the business will recover the VAT it pays on its inputs.

VAT Structure in the European Union

Harmonization of VAT

The European Union has established a common framework of VAT with the aim of simplifying cross-border trade and giving businesses certainty about the rules they must follow. The legislative framework that applies to VAT within the European Union is provided by the VAT Directive, which is Council Directive 2006/112/EC and forms the basis of the legislation governing how VAT is applied in member states.

Main Characteristics of the EU VAT System

- Standard VAT Rate: EU member states are obliged to apply a standard VAT rate, and such a rate is required not to be less than 15%. Additionally, every member state may determine its own reduced rates - usually between 5% and 15% - that might apply to specific goods and services, such as food, pharmaceuticals, and public transport.

- Zero Rating: Some goods and services might be zero-rated for VAT purposes, or a 0% VAT rate may apply. This is particularly true for commodities of a staple nature, such as staple food, healthcare services, and educational tools.

- Intra-Community Transactions: VAT allows zero rating on goods sold to other member states because of the free movement principle within the EU. Businesses should, however, adhere to some rules so that the said transactions are appropriately reported and accounted for.

- VAT Returns and Compliance: Every business enterprise involved in the European Union has to submit periodic VAT returns to the presiding tax authority. These VAT returns would comprise the VAT on sales collected and VAT paid on purchases, thereby allowing businesses to offset excess VAT against the amount paid.

VAT Rates in the European Union

Current VAT Rates

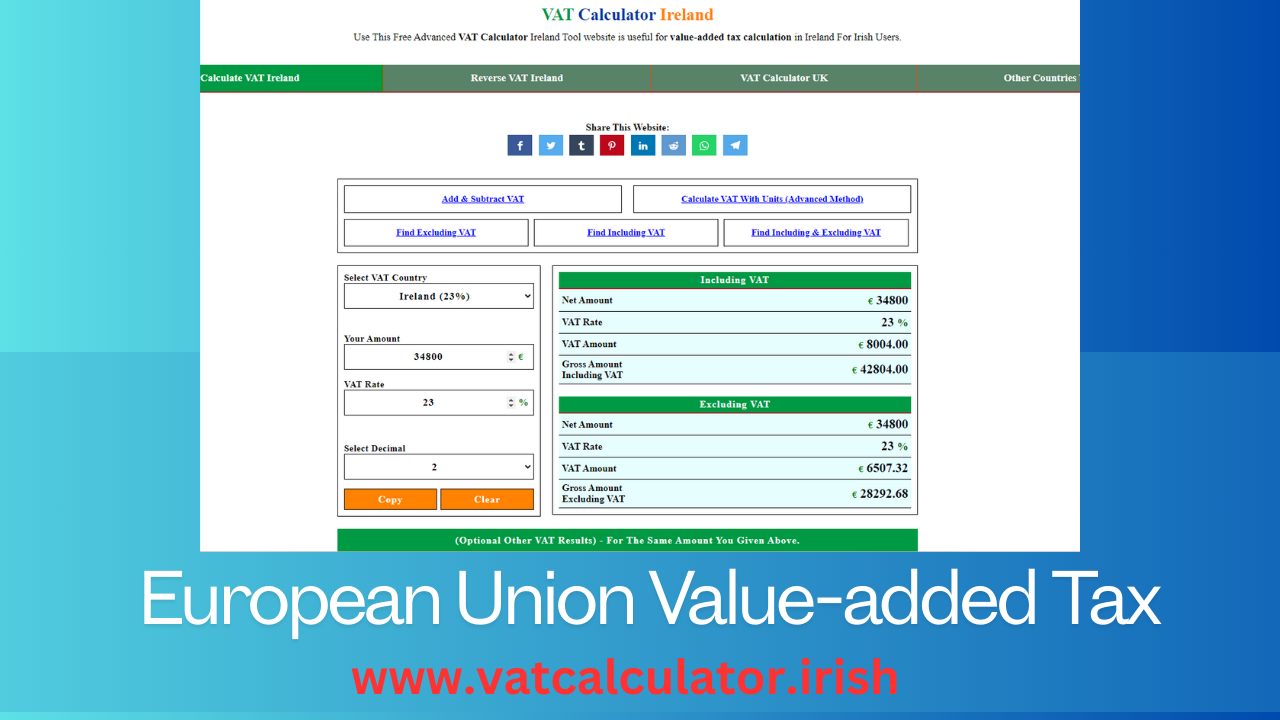

In 2023, EU member states apply different VAT rates, which reflect national priorities and economic conditions. Consequently, the standard VAT rates for some EU countries are as follows:

- Germany: 19%

- France: 20%

- Italy: 22%

- Spain: 21%

- Ireland: 23%

Of course, these are not the only rates that apply in those countries, due to a number of reduced rates on specific goods and services, which proves the flexibility within the EU framework.

Reduced and Exempt Rates

Reduced rates are available for specific categories of supplies, and such reduced rates make a huge difference in consumer prices and business operations. For instance, several countries apply reduced rates of VAT on food items and medical supplies just to ease the burden on consumers.

Business Implications of VAT

Compliance Requirements

For companies operating their activities in the European Union, compliance with the various VAT regimes is strictly a serious affair. This means a company is obliged to register for VAT in countries where they operate and comply with local legislation related to invoicing and bookkeeping. Companies that deal in export trade might find this process particularly cumbersome since various VAT systems have their requirements.

Cash Flow Management

VAT can have an impact on the cash flow of a business, particularly if the company has significant input VAT to recover. Firms should manage their cash flow properly in order for them to have sufficient liquidity to fund the payment of VAT on purchases against its recovery through VAT return.

Pricing Strategies

Comprehension of the VAT rates: This is important for the price strategy. Any business entering the market should keep in mind that their pricing models will be affected by the final price after the addition of VAT. For example, a merchandise item that has a selling price of € 100 will also be subjected to an increase in its ultimate price, after charging 20% VAT on it. In this case, € 120 would be the final price that the consumer would be paying for the item.

Small Business VAT Schemes

Because of this, the EU does make allowances for some simplified VAT schemes designed to support small businesses. This will in practice probably help reduce the burden of compliance, which would make it easier to handle VAT more effectively for small enterprises. Taking once more the example of the VAT MOSS, which allows digital service providers selling across EU borders to declare and pay VAT in one member state only instead of registering for VAT in multiple countries.

VAT and Consumers

Impact on Prices

It follows that the ultimate bearers of this cost are consumers, as businesses pass the burden to them in the form of higher price levels. This effect will, of course, vary based on the particular good and service having a certain VAT rate applied. Knowledge of VAT rates will also help consumers make informed purchasing decisions and budget accurately.

Awareness of VAT

VAT awareness among consumers can thus shape consumption patterns. For instance, once consumers are aware that certain staples attract zero or lower rates of VAT, they may prefer those products over others that are rated highly.

Government Revenue

VAT is a major source of revenue for the member states of the European Union, especially in terms of its contribution to national budgets. This, therefore, provides funding for public services, infrastructural projects, and as well social initiatives, and hence a very important aspect of fiscal structure.

Challenges in the EU VAT System

Fraud and Evasion

VAT fraud, especially carousel fraud, is one of the significant issues being faced by the EU VAT system. The fraud involves taking benefit of the process by businesses through claiming a refund of VAT never paid. Till now, the EU has taken different measures in the fight against fraud under the VAT system, but fraud as an issue is still prevalent and results in revenue losses.

Digital Economy and VAT

The digital economy also brings new challenges for the application of VAT, as many of these services are delivered cross-border. This increases the complexity of VAT compliance and its collection. To address this challenge, the EU has introduced the DST and also widened the coverage of the MOSS scheme to ease VAT declarations by digital service providers.

Brexit Implications

The Brexit issue, whereby the United Kingdom has exited the EU, will have significant implications for VAT in the next few years. Businesses operating between the UK and EU member states must make arrangements for new customs and VAT regimes that could have consequences on trade and pricing strategies. Businesses are supposed to adapt the VAT compliance procedures to this development.

The Future of VAT in the EU

The VAT system, much like the constantly developing and changing EU, will do likewise. Nowadays, it has become a regular thing to hear discussions on how it could be improved for better compliance, fraud reduction, and adaptation to changes in the world economy. Some of the possible reforms that could be brought into place relate to:

- Simplification of VAT Compliance: The simplification of the compliance procedure aims to make business easier in Europe, particularly for the SMEs. Harmonization and simplification of different reporting requirements can reduce the burden on business, as well as better e-facilities, for easier compliance with the VAT regime.

- Addressing E-commerce Challenges: E-commerce growth requires a reconsideration of the VAT policies in place so that they can effectively capture revenues deriving from e-sales. The EU addresses the issue of how to increase VAT compliance for e-commerce companies to make certain that fair competition is ensured along with proper revenue collection.

- Sustainability and VAT: There is, therefore, greater realization in this perspective of how VAT can contribute to sustainability. There is a continuing debate among its member states on how VAT rates can be designed or adjusted so as to provide incentives toward environmentally friendly goods and services in such a way that would, in effect, enable the tax policy to support sustainability goals on the whole.

Conclusion

Value-added tax in the European Union is a very important constituent of the overall tax system that the EU has adopted, impinging as it does on the world of business, consumers, and government revenues. A harmonized EU VAT encourages cross-border trade, yet allows member states to set rates in relation to their economic needs. The understanding of VAT implications in business will be greatly helpful to enterprises in considering compliance and pricing strategies, as well as for consumers to make better choices about their purchases.

Final Thoughts on the EU VAT System

While the EU remains beset by economic challenges and opportunities, respectively, the VAT system is bound to continue changing in order to accommodate the needs of businesses and consumers alike. Ongoing efforts at simplifying compliance, combating fraud, and adapting to the digital economy will be crucial in ensuring that the VAT system remains both effective and sustainable. Eventually, VAT will go on to play a significant role in funding public services and supporting economic growth across the European Union.